2020 was a strange year in many ways. We experienced social unrest, a global pandemic, and a recession…all in one year. Disparate groups, regions, and ideas stretched the country in different directions, sometimes nearly to the breaking point. And in the midst of all this – we also saw record-breaking equity markets, some rich getting richer, and an ever-widening income gap disparity.

You want some examples? Here you go…

- Racial conflicts and massive protests in every city in the US and even worldwide, sparked by the death of George Floyd by a Minneapolis police officer

- 2020 Presidential election legal battle – Democrats and Republicans fighting tooth and nail for each and every college elector, and Donald Trump exhausting every possible legal means to dispute and overturn the election results

- Vastly different Covid-19 safety policies and procedures – ranging from some states that are completely open with few rules in place (such as Florida) to others that are almost completely shut down with a long list of restrictions (such as California)

- After a brief Covid induced crash, the equity markets have reached crazy heights and many say stock valuations are completely unreasonable

Look For These Emerging Technologies and Companies in 2021

Despite all of these negative things, there are some bright spots in the future. We are forging ahead with emerging technologies that improve our lives, many of which have seen record adoption this year due to the pandemic (such as food delivery apps, e-commerce, tools for working from home, and others). Here is a list of the tech trends and corresponding companies that I’m watching in 2021 and beyond:

Digital Health and Telehealth

Considering the damage the pandemic has done, one good thing that has come out of it is the acceleration of digital health and telehealth.

In terms of funding, this year is the largest on record for the sector. For VC investment, the median deal size through Q3 2020 is $39 million—up from $25 million in 2019 and $18.9 million in 2018, signaling “industry maturity,” according to Kaia Colban, an emerging tech analyst at PitchBook.

The pandemic also drove research in diseases and drug discovery, as companies focused on studying and/or developing a vaccine for Covid-19 – particularly in the use of AI for those purposes. Mike Paylor, VP of engineering and product for Upwork, says he’s seen a lot more demand for healthcare apps and, in particular, AI for healthcare. In addition, researchers put many of their existing research and clinical trials on hold to focus their attention on a Covid vaccine. And the record speed with which the Covid vaccines by Pfizer, Moderna, and AstraZeneca were tested, trialed, and brought to market will likely have a lasting impact on the pharmaceutical industry. Remote clinical trials, performing consultations online, and collecting data remotely may also be a permanent part of future pharmaceutical trials long-term.

We’ve also seen a rise in telehealth, allowing patients and caregivers to communicate remotely. There was a 154% increase in telehealth visits during the last week of March 2020, compared with the same period in 2019, according to the CDC.

Abacus Insights, Amwell, Kaia Health, LetsGetChecked, Mindstrong, and Plushcare are all startups that have raised Series A, B, or C rounds during the pandemic and “decentralize medicine away from hospitals and empower patients as consumers”, according to Bond Capital’s Mary Meeker.

And speaking of AI…

Artificial Intelligence, Machine Language, and Robotics

In 2020, artificial intelligence (AI) and machine language (ML) made big strides in technology.

Businesses have access to more data than ever on their customers, competitors, and the market as a whole. AI tools have helped them to do that, and there doesn’t seem to be any looking back.

- A recent McKinsey survey found that half of organizations worldwide have adopted AI in at least one function.

- But another global survey found that less than half of adopters say they’re highly skilled at integrating AI into their existing environments.

What this means that the demand for skilled AI specialists and more standardized, user-friendly AI tools will only increase in the coming years. And the fast-growing field of ML operations (MLOps) is helping to provide some of those tools. Specialists trained in ML Ops are the ones that help deploy, train, and run those AI models.

In 2021, expect to see huge demand and rapid growth of AI and industrial automation technology. As manufacturing and supply chains return to full operation, manpower shortages will become a serious issue. Automation, with the help of AI, robotics, and the internet of things, will be a key alternative solution to operate manufacturing.

Some of the top technology-providing companies enabling industry automation with A.I. and robotics integration include:

UBTech Robotics (China), CloudMinds (U.S.), Bright Machines (U.S.), Roobo (China), Vicarious (U.S.), Preferred Networks (Japan), Fetch Robotics (U.S.), Covariant (U.S.), Locus Robotics (U.S.), Built Robotics (U.S.), Kindred Systems (Canada), and XYZ Robotics (China).

Last-Mile Delivery Tech

Due to the pandemic, more people are ordering food deliveries and shopping online. “No contact” delivery is now the “new normal”. This created a huge demand for last-mile delivery tech companies and autonomous delivery capabilities. Startups like Arrival have partnered with UPS, and Rivian which partnered with Amazon to deliver your goods in electric vans. Amazon and Walmart are still locked in a never-ending episode of “Battle of Delivery Drones”. And shipping giants like FedEx are rolling out autonomous same-day delivery bots.

What’s spurred this activity on? Several things really.

- Obviously, the pandemic has shifted the delivery landscape from “personal touch” to “touchless/no contact”

- Uber acquired Postmates in July

- California passed Proposition 22 in November, which exempts gig economy companies (such as Uber and Doordash) from providing employee benefits to workers. And these companies are already working to expand it to other states.

- DoorDash had an IPO in December

- Instacart’s IPO is looking like it will happen in Q1 2021

- All of the industry leaders are focused on moving beyond just food delivery and expanding into retail and convenience

Edtech, Online Learning, and Future of Work

Edtech had already been growing pre-Covid, but Covid just accelerated that growth even faster. It also put “online learning” at the forefront of many educators. During the pandemic, 190 countries enforced nationwide school closures at some point, affecting 1.6 billion students (91% of all students worldwide).

17zuoye, Yuanfudao, iTutorGroup, and Hujiang in China, Udacity, Coursera, Age of Learning, and Outschool in the U.S., and Byju’s in India are some of the online learning platforms that have benefitted from the pandemic and will continue to experience tremendous growth even after we go back to a “normal life”.

And of course, most of us are familiar with Future of Work apps like Zoom, Slack, Airtable, Calendly, and others. But there are others that may be less well-known but equally as promising: Deel (payroll from remote teams), Guru (a better knowledge database), Notion (an “OS” for startups), and Zapier (a way to synchronize information across apps).

Many of these new behaviors driven by pandemic will outlast the virus and continue to accelerate in 2021 and beyond. This will help drive future technological innovation in these areas and help the adoption of what may become our new “normal”.

#emergingtechnology #emergingtech #emergingtechpredictions #Covid-19 #digitalhealth #telehealth #artificialintelligence #AI #robotics #deliverytech #lastmiletech #edtech #onlinelearning #futureofwork

What is your opinion? Feel free to contribute in the comments below.

Please feel free to share/repost/retweet

Let’s dive a little deeper

Let’s dive a little deeper

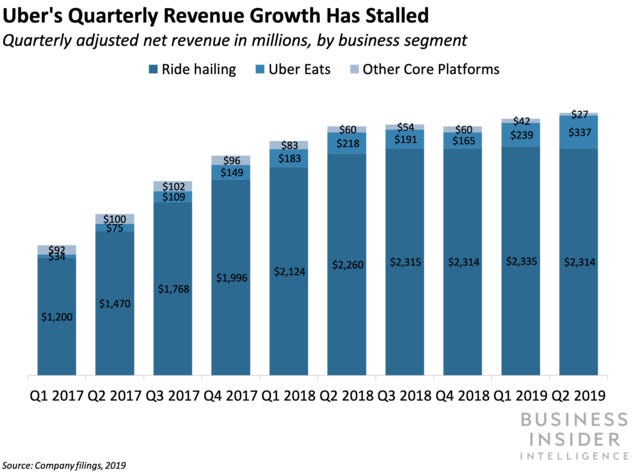

In my last post, I discussed how Uber Eats and its potential acquisition of Grubhub might just be Uber’s savior. Well, this is just off the presses…Uber has failed in its takeover attempt of Grubhub. Just this morning, Just Eat Takeaway, a Dutch company, has agreed to acquire Grubhub for $7.3 billion.

In my last post, I discussed how Uber Eats and its potential acquisition of Grubhub might just be Uber’s savior. Well, this is just off the presses…Uber has failed in its takeover attempt of Grubhub. Just this morning, Just Eat Takeaway, a Dutch company, has agreed to acquire Grubhub for $7.3 billion.