Let’s dive a little deeper

Let’s dive a little deeper

Due to the Coronavirus pandemic and corresponding stay-at-home orders, it should be obvious to anyone that ridesharing has pretty much halted the past few months. Going forward, unless Uber incorporates a physical barrier/screen between the driver and passenger (in the backseat), the minimum recommended distancing of 6 feet apart isn’t going to be met in a rideshare situation. And forget about Uber Pools for the time being. It will likely be a while before most people are comfortable sitting in a vehicle in close proximity to 3 other people. (I would venture that the ridership numbers for Uber Pools will suffer worse than Uber X rides during the Covid period.) Basically, the pandemic has effectively cratered Uber’s rideshare business for the foreseeable future.

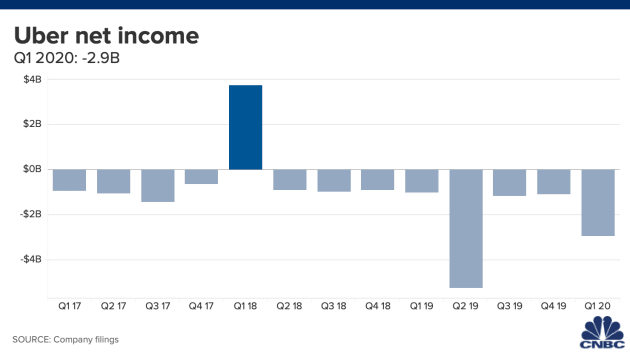

The ride-share segment was down 80% and reported a $2.9 billion loss in Q1 2020, it’s largest loss in three quarters.

Other Issues

During the pandemic, Uber laid off 3700 full-time employees (14% of its workforce) and another 400 employees from its bike and scooter division, Jump, as part of an investment deal offloading that business to Lime.

And Uber is also dealing with a new lawsuit in California that claims Uber wrongfully classified drivers as contractors rather than employees to avoid paying for overtime, reimbursement for business-related expenses, access to unemployment and disability insurance, paid sick leave, and other benefits.

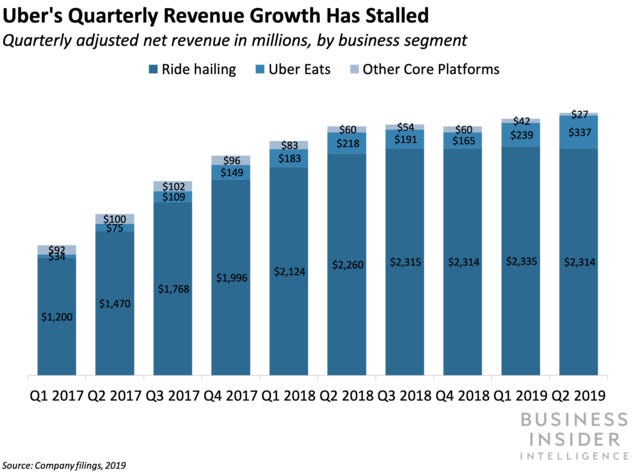

Given the massive losses that Uber has sustained since its inception from its ride-sharing segment and the promising growth of the food-delivery segment as discussed in part 1 of this post, pushing its food delivery business might seem like the logical way forward to eventual profitability. After all, Uber Eats reported adjusted net revenue of $1.4 billion in 2019, an increase of 82% over the previous year.

However, those numbers don’t accurately reflect the real impact of the business’s growth on Uber, and when you take a deeper look into the food delivery business, you see that the economics make it difficult to see a long term path to profitability.

During the same period that Uber reported the adjusted net revenue of $1.4 billion, it also reported EBITDA of -$461 million. Much of this loss came from “increased investments in key markets that delivered category position improvement.” You’re probably asking, what does that mean exactly? It means that Uber spent 45% of its revenues ($1.13 billion) on “excess driver incentives”. Again, you’re probably wondering, well what does that mean?

“Excess driver incentives” is the term Uber uses to describe two things, either paid new driver referrals (usually from an existing driver) or financial losses on rides and deliveries. Also mentioned in part 1 of this post, Uber has been very aggressive in grabbing market share in some areas, much to the detriment of its bottom line. In order to get drivers on board and lower prices as much as possible, Uber essentially loses money on every ride. And since it pays the driver more than it collects in revenue, it chalks it up to a cost of doing business to gaining dominant market share. While this has worked well to some degree so far, it is unsustainable in the long run.

This is why Uber purposely breaks out what it pays drivers in excess incentives so that it can easily show investors what the impact on profit would be if it eliminated these incentives. And if it’s not clear by now, the plan is to certainly eliminate this expense as much as possible in order to become profitable.

So about that “Uber Eats savior thing” again…

Even as Uber Eats seems to be a path forward for Uber to gain profitability, it is a road littered with obstacles and fraught with dangers. Food delivery companies basically earn money from delivery fees and revenue share with restaurants. And to sign up some bigger restaurant chains, the food delivery companies have had to lower their commissions. On top of that, several cities have now started capping the fees they can charge restaurants. Seattle, San Francisco, Washington D.C., and Jersey City have all instituted some sort of cap on delivery fees with other cities expected to follow suit. Other cities such as Chicago have forced the companies to reveal what exactly constitutes the total delivery fee by itemizing everything including the actual delivery costs, taxes, food costs, and the commissions and service fees restaurants pay.

All of these factors contribute to a murky outlook for Uber’s future. While it still continues growing, its profitability will continue to be a big question mark.

But, there are solutions

Recent polling data suggests that somewhere between 13 and 20 percent of folks in the U.S. say that they’ll start venturing back out once their regional shutdowns are lifted, and about half, CBS News reports, say they won’t resume normal social activity until it’s clear the outbreak is over. If those numbers are accurate, Uber’s Rides’ business is likely down for the long haul, Eats will continue to shine, and Uber will be best served by going where the money is: food delivery.

Consolidation is the way forward in the food-delivery business, and Uber understands that very clearly. As part of the quote mentioned in part 2 of this post, Uber stated “like ridesharing, the food delivery industry will need consolidation in order to reach its full potential for consumers and restaurants”. I’m just wondering if they just lost their best potential partner (Grubhub) and may now have to settle for the leftovers (Postmates). Despite that, look for a merger with Postmates in the coming months.

In my opinion, Uber Eats might just be the new savior…and possibly the only one for Uber.

#uber #ubereats #coronavirus #covid19 #ridesharing #businessstrategy #justeattakeaway #mergersandacquisitions #doordash #grubhub #postmates

What is your opinion? Feel free to contribute in the comments below.

Please feel free to share/repost/retweet

In my last post, I discussed how Uber Eats and its potential acquisition of Grubhub might just be Uber’s savior. Well, this is just off the presses…Uber has failed in its takeover attempt of Grubhub. Just this morning, Just Eat Takeaway, a Dutch company, has agreed to acquire Grubhub for $7.3 billion.

In my last post, I discussed how Uber Eats and its potential acquisition of Grubhub might just be Uber’s savior. Well, this is just off the presses…Uber has failed in its takeover attempt of Grubhub. Just this morning, Just Eat Takeaway, a Dutch company, has agreed to acquire Grubhub for $7.3 billion.